are hearing aids tax deductible as a business expense

The deductions for these costs are only available to those who itemize their expenses. So if you need a hearing aid just for your work say.

Are Medical Expenses Tax Deductible Chime

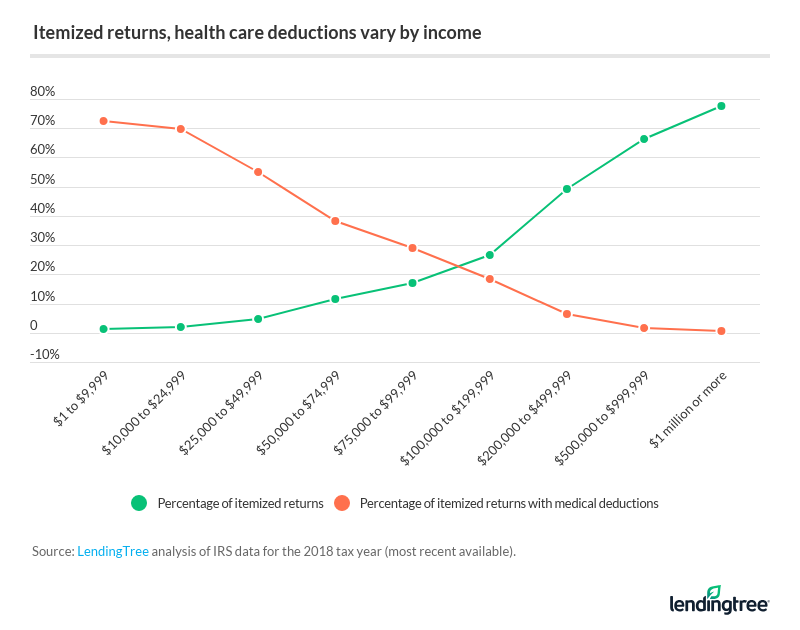

The cost of hearing aids can be as high as 75 of your adjusted gross income so.

. This means that they can be deducted from. What are hearing aids. IRS Publication 502 spells out allowable.

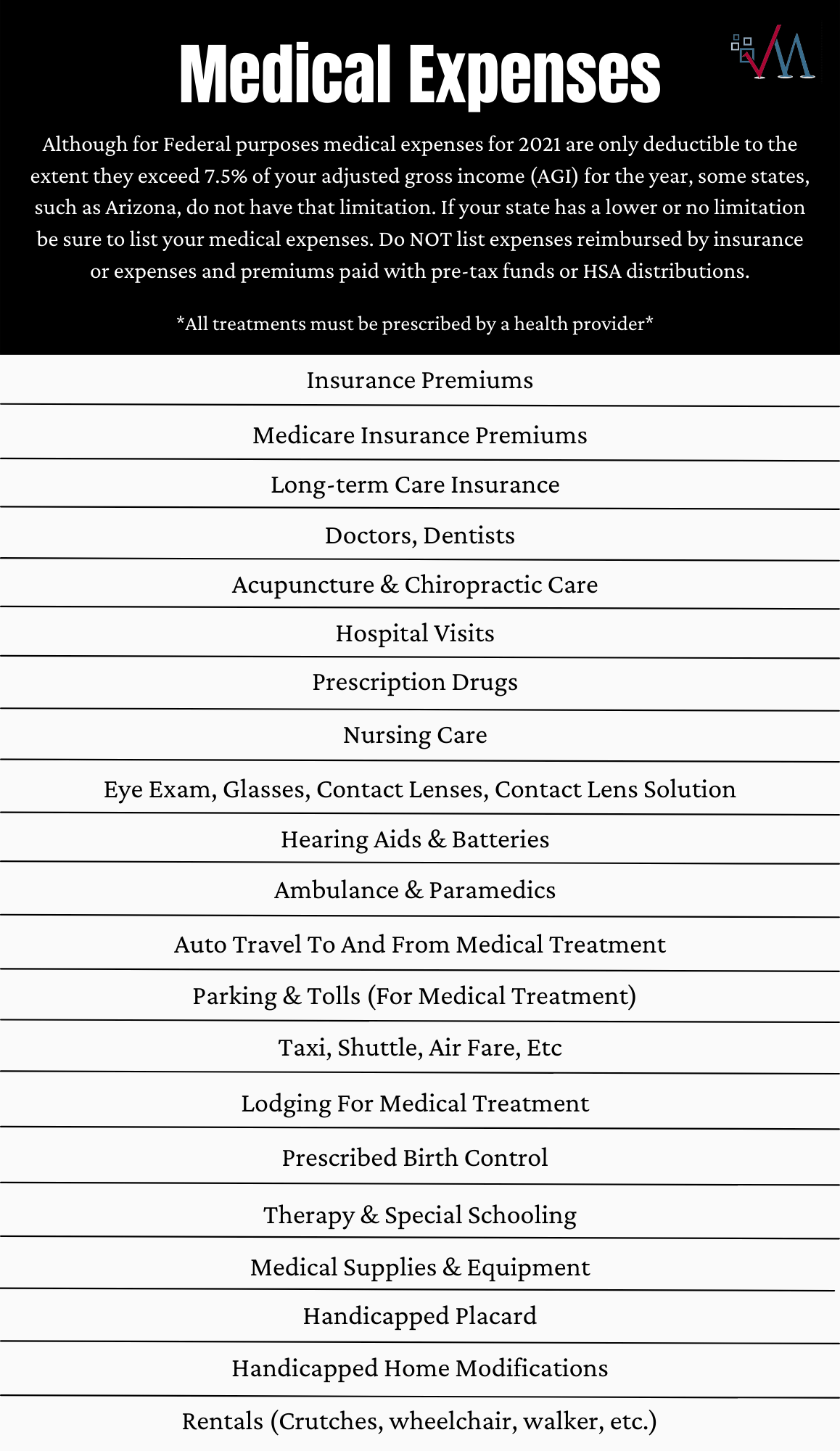

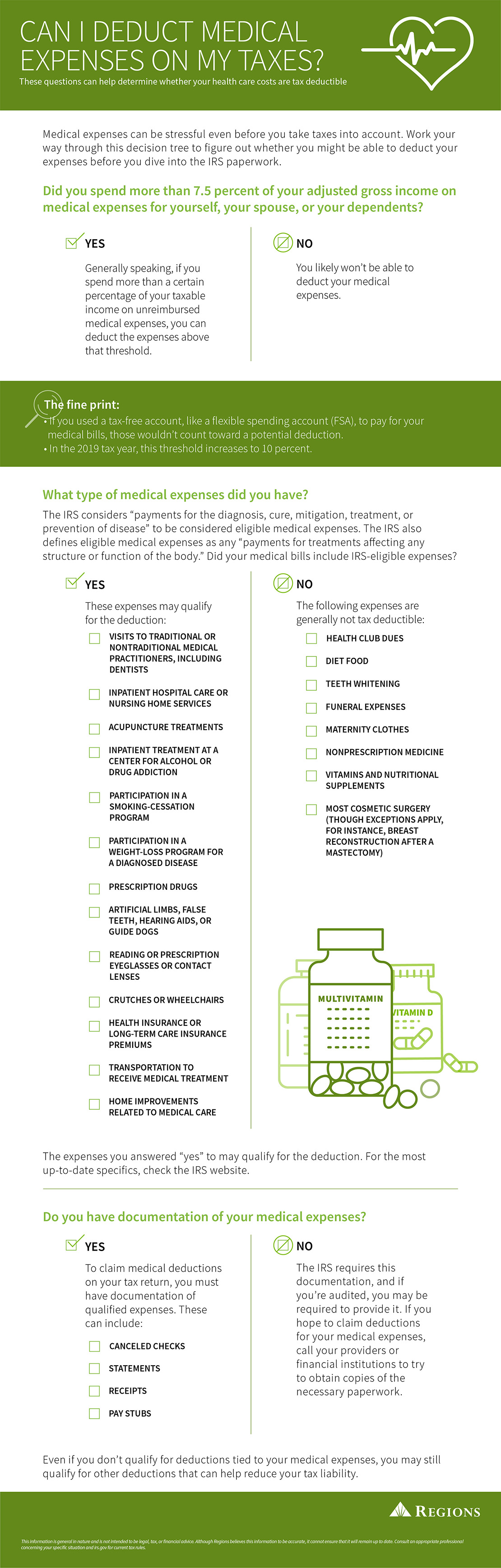

Hearing aids are generally tax deductible but there are some IRS rules you need to know. The good news is that if you are prepared to itemize your medical expenses you can save money. The good news is that if you are prepared to list and itemize your medical expenses you can save money by writing off your hearing aids as a tax-deductible expense.

The high cost of hearing aids can mean that millions of americans avoid buying a hearing device because they can. How are hearing aids tax deductible. Hearing aids are most certainly a medical expense that is tax-deductible in Canada.

While this puts hearing aids beyond many peoples typical monthly budget there are actually quite a few ways. First hearing aids are considered medical expenses. There are a few things to know about hearing aids and taxes.

The tax rules state that if the expense is incurred wholly and exclusively for your business then you can have tax relief for it. These out-of-pocket premiums should be. The cost of hearing aids is deductible as a medical expense on your federal income taxes.

The IRS classifies hearing aids as a medical. You can deduct the cost of a hearing aid as a medical expense as well as its batteries repairs and necessary maintenance for it. Health Costs Doctor visits gym memberships glasses hearing aids or massages.

Hearing aids on average cost between about 1000 and 4000. Hearing aids have been. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

By deducting the cost of hearing aids from their taxable income wearers could reduce. However there are saidsome things to consider and. I believe that in the case of a director the cost of hearing aids would be an allowable expense for the company but would indeed be considered a P11d benefit.

The short and sweet answer is yes. Can hearing aids be claimed as a business expense. Are Hearing Aids Tax Deductible As A Business Expense.

A client lawyer wants to deduct hearing aids as a business expense not medical for obvious 75 reason since he bought the aids to hear the judge during evidentiary.

Blog Tax Related Mendoza Company Inc

18 Medical Expenses You Can Deduct From Your Taxes Gobankingrates

How Much Do Hearing Aids Cost Goodrx

What Qualifies As A Medical Deduction Tl Dr Accounting

10 Can T Miss Tax Deductions For Small Businesses Self Employed Persons

Hear It Now E3 Diagnostics Blog

Are Medical Expenses Tax Deductible Credello

What Medical And Dental Expenses Tax Deductible

How Much Do Hearing Aids Cost Without Insurance Mira

/MedicalExpenseDeductions-46840a26340a4803837a61ea5a199c84.jpg)

20 Medical Expenses You Didn T Know You Could Deduct

Tax Prep Checklist The Documents Needed To File Your Taxes

Can I Deduct Medical Expenses On My Taxes Regions

Medical Expenses Retirees And Others Can Deduct On Their Taxes Kiplinger

Seo And Tax Deductible Business Expenses A Complete Guide

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

Five Common Questions To Ask Yourself About Tax Deductible Expenses